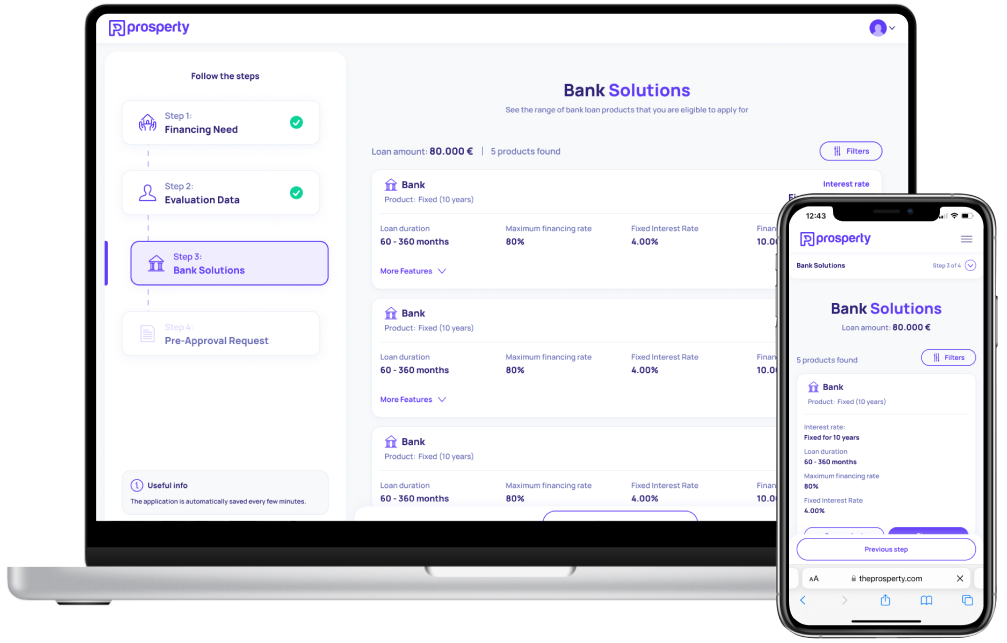

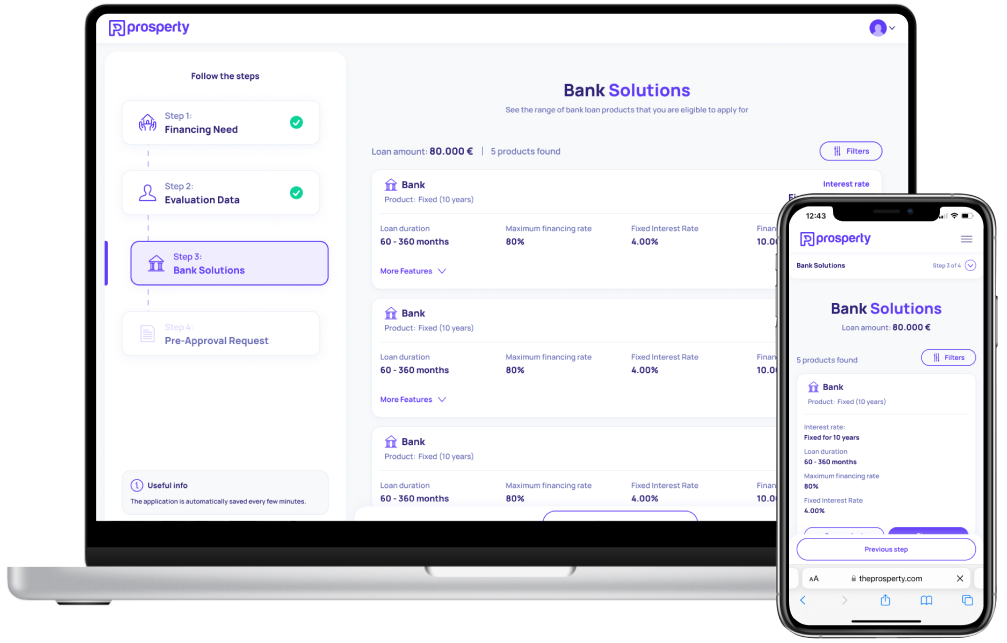

Prosperty Mortgage

Skip the bank visit and get approved faster than ever

With our AI-powered digital mortgage application

Our approach

Purchasing a home is an exciting and significant decision, and obtaining a mortgage pre-approval is a crucial step toward achieving that goal.